Sarasota Insurance Agency >> blog

MIAMI/SOUTH FLORIDA Event planners are often puzzled over whether to purchase event insurance, and if they do, exactly what they need to insure. Whether it's an intimate cocktail party or a black-tie benefit, an indoor or outdoor event, a passive or interactive experience, some things are always out of your control. BizBash Florida dug deep into the insurance arena to clarify what event insurance is needed, who needs it, what it covers, and how to get it.

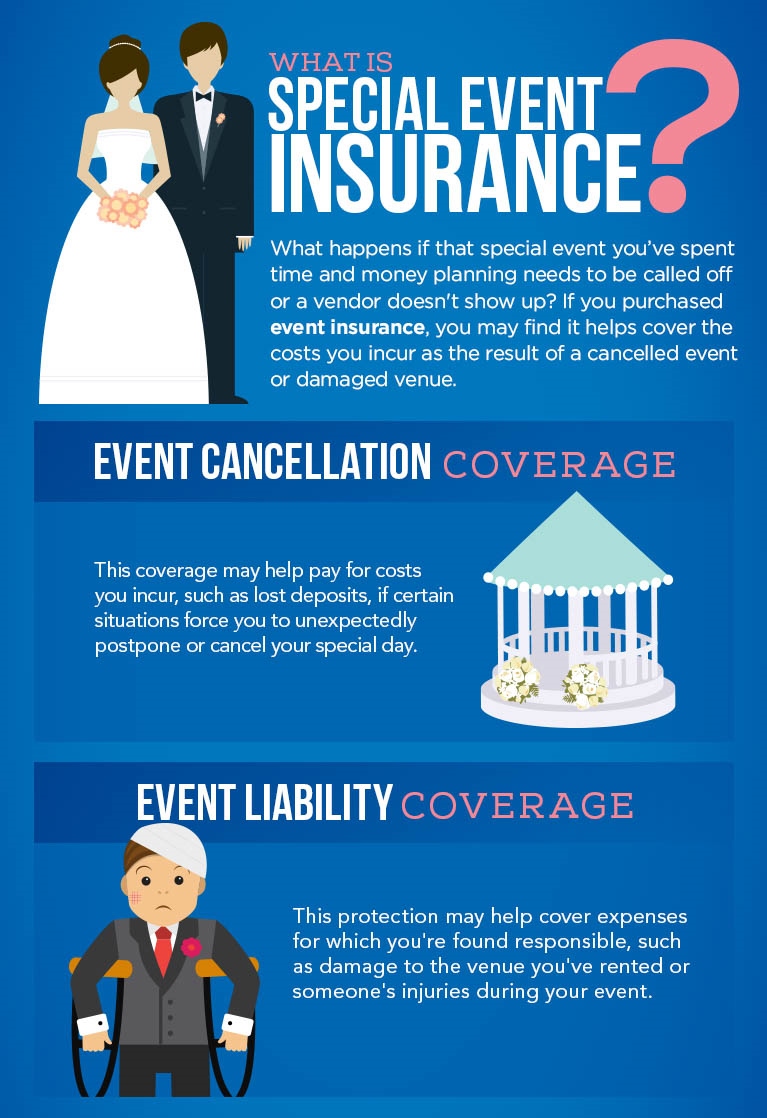

What is event insurance? Insurance associated with events covers and protects planners in several specific areas. Nick Sirianni of Chicago's Aon Corporation, an insurance and risk management agency, explains, “event insurance provides general liability for specific events.” Planners can purchase additional coverage that protects them from such things as liquor liability and event cancellation.

· General Liability insurance protects a company and all parties involved in the event-the planner, venue, caterers, etc., for losses due to bodily injury or property damage caused by the insured's employees or agents. Venues and agents will usually require liability for $1,000,000.

An unlimited number of your vendors and venues may be provided with certificates of insurance naming them as additional insured in the event of a loss.

Occasionally a vendor will request a waiver of subrogation, which prevents your insurance company from recovering any funds from the vendor if the claim was due to the vendor's negligence. A separate premium applies.

· Liquor liability insurance is sometimes necessary, especially if you are in a venue in which the bartenders are not covered or if you directly employ any part-time bartenders.

Liquor liability covers arising from causing or contributing to the intoxication of a person; the accidental furnishing of alcoholic beverages to a person under the legal drinking age or under the influence of alcohol, or any statute, ordinance, or regulation

relating to the sale, gift, distribution, or use of alcoholic beverages.

· Cancellation insurance will protect you in case of unforeseen situations such as inclement weather, including hurricane, if a

venue is deemed unusable, or something else that requires you to cancel an event. This helps you cover many of the costs

and deposits already paid.

· Third-party damage insurance covers damages to a location while it is under your control, protecting you from having to pay

for repairs.

· Hired/Non-owned Auto Liability provides liability coverage for vehicles rented specifically for the event, and auto-related injury

to third parties or damage to their property. Hired auto physical damage covers damages to vehicles you rent.

· Worker's compensation provides medical benefits and salary compensation to your employees for injuries sustained while

in your employment. “It is mandatory in the state of Florida and event planners should be aware of their legal obligation and requirements, ” says Marie Anello, vice president of Kahn Carlin & Company Inc. in Miami.

· While not as likely as someone getting injured at an event, terrorism insurance is an option to be aware of. “In this day and

age, terrorism insurance should be considered, depending on the type of event being held, since it is specifically excluded

under policy forms unless purchased,” Ms. Anello says.

Why you need Special Event coverage. In a society where litigation runs rampant, it's always best to protect yourself from ever having to deal with those worst-case scenarios, especially if you're the one in charge.

“An event planner is like a general contractor: They're at the top of the chain of responsibility and need to protect themselves in case someone has an accident and sues the venue or host and tries to bring them in as well,” says John Jennings, underwriting manager for Missouri-based M.J. Kelly Company.

Javier Velarde, the owner of Trinton Production in Miami Beach, agrees to the importance of covering yourself.

“We did an event, and at the end of the night, a guest was drunk and had your basic slip and fall,” Velarde says. “He sued everyone-the venue, the production company, the company throwing the event, everyone. Luckily, we were covered, and the insurance company settled.”

It's not just for your own protection. Many venues and vendors won't do business with a planner or company that doesn't have insurance.

Choosing the best policy. With so many terms flying around in the world of insurance-“liquor liability,” “general liability,” “additional insured"-it's hard to know what is right for you. Most companies and planners purchase general liability, which provides broad coverage for such incidents as people slipping and falling or a faulty product passed out in a gift bag.

You can then consider the importance of including other coverage at an additional cost. Your safest bet is to purchase personal insurance for yourself. Some planners request that the client for whom they're planning the event add them to their company policy as additionally insured. But in the long run, that may not be enough.

“If they add themselves to the company policy, it only protects them if the company itself is involved in the accident. If the planner is negligent about something and the company wasn't involved, it won't protect the planner. I would recommend they get liability for themselves,” says Jennings.

Stacy Stern, president of the Special Event group in Boca Raton believes in covering all her bases and does both. “Ideally, the corporation should list the planner as additionally insured and all vendors should list her as insured,” says Stern. “Vendors have to list me. Otherwise, I won't work with them.”

How to get it. The first step is to call your own insurance agent and find out if you're already covered, and for what. In some business policies, event coverage is automatic. Be sure the insurance carrier is financially stable and has a well-defined program for special events insurance.

Remember that things like liquor and weather are add-ons, and you are responsible for informing your insurance agent if you plan to serve alcohol at an event.

“The client may need commercial liquor liability coverage or host liquor liability, depending on their role in an event,” says Steve Russell of Agency Marketing Services in St. Pete Beach. Russell also recommends that the insured obtain a copy of the policy in advance, to verify that all coverage is taken care of before the event takes place. Many companies also opt to get a onetime event policy separate from the one that covers their day-to-day business. This effectively isolates the event, so that any incidents that occur do not affect the planner's regular insurance plan. The best bet for planners is to purchase blanket coverage for all events. Then you need only inform your agent whenever you are having an event, instead of drawing up a new policy for each one individually.

Cost. Prices will always vary. General liability cost is based on the type of event, its duration, and the number of people attending. But after tossing around different scenarios with insurance experts to determine the general-liability cost of insuring a black-tie benefit for more than 500 people, including liquor and live entertainment, we estimate a price range of $400 to 600 for the typical $1 million policy. Certain additions, like a policy covering a terrorist attack, can be added with a 1 to 2 percent surcharge.

No matter the size of your event or how well prepared you are, you never know when the worst-case scenario could become your reality. According to Velarde of Triton Productions, it's the small things that cause the most problems if you're not properly covered. So even the most basic coverage policy could prove to be a big help in the long run. Having the proper insurance can make the difference between a minor bump in the road and a complete detour.

Original Source: https://www.bizbash.com/when_and_why_you_need_event_insurance/miami/story/9433/#.XFm7rlVKjRY%E2%80%8B%E2%80%8B

2019-02-07 10:21:05